san antonio tax rate property

San Antonio TX 78205 Phone. 33 rows San Antonio citiestowns property tax rates The following table provides 2017 the most common.

All Of Us Are At A Breaking Point San Antonio Bexar County Leaders Look To Austin For Property Tax Relief

Bexar County has one of the highest median property taxes in the United States and is ranked 282nd of the 3143 counties in order of median property taxes.

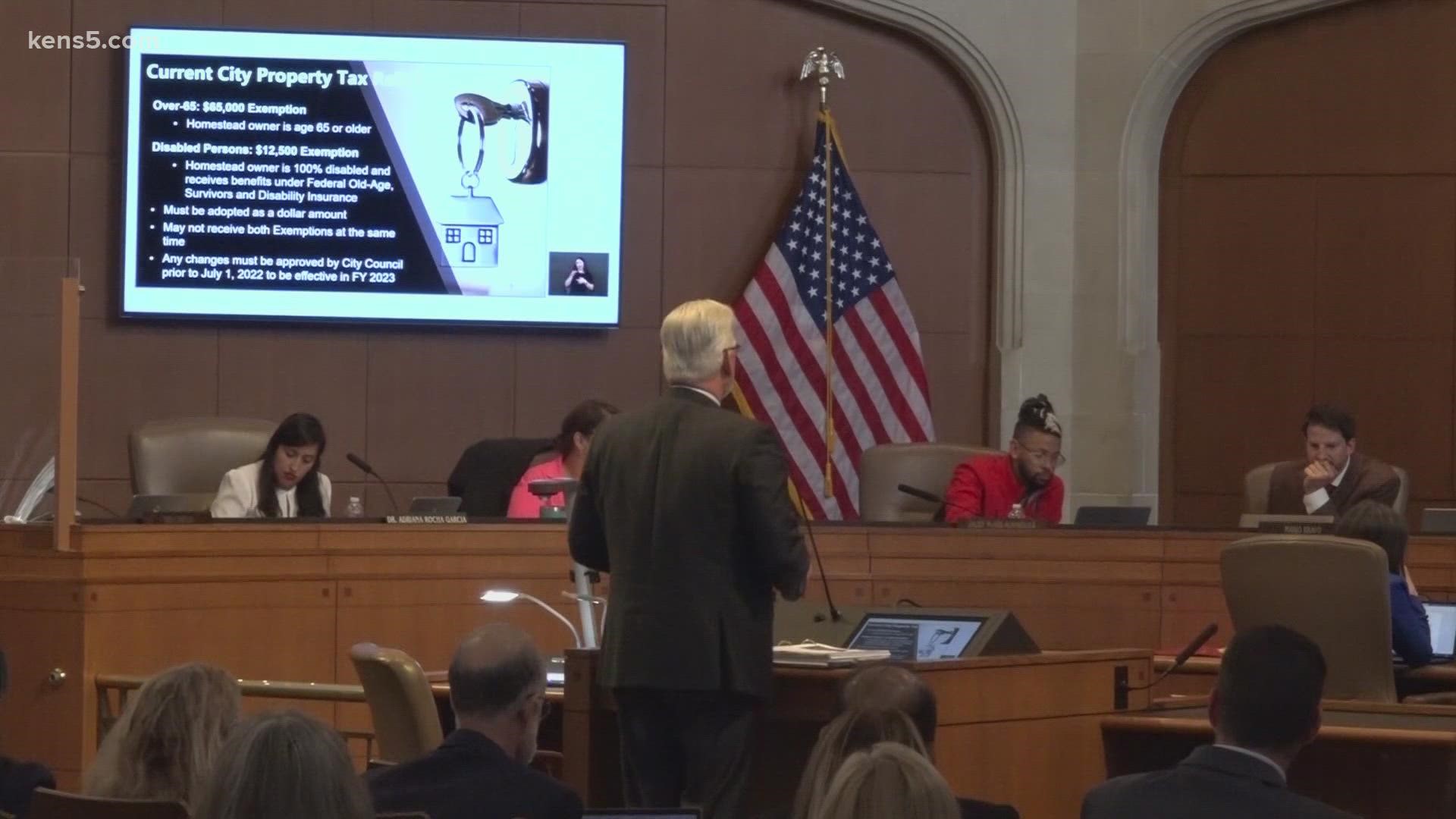

. The process used is dependent on benchmark rates known as the effective tax rate and the rollback rate. The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. SAN ANTONIO San Antonio City Council was presented its trial budget for the 2022-2023 fiscal year on Wednesday and city staff say they will be providing property tax relief to homeowners.

Maintenance Operations MO and Debt Service. The cap used to be 8 before SB2 went into effect. The FY 2022 Debt Service tax rate is 21150 cents per 100 of taxable value.

San Antonio residents pay almost 57 cents in property taxes per every 100 dollars. County Departments. That includes the city school and municipal utility rate but does not include any special districts.

Legislators in 2019 passed Senate Bill 2 which mandates a property tax rate rollback if property tax revenues go about 35 over the previous year. Ad Get a Vast Amount of Property Information Simply by Entering an Address. Alternatively the city could exceed the revenue cap but doing so would trigger an election asking voters permission to keep the additional tax revenue per the new law.

Tax bills in San Antonio typically increase because of climbing property values or school district rate increases. Search Any Address 2. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at.

Elliott stressed that lowering the tax rate from 055827 to 054504 as laid out in his presentation was just a. In San Antonio the countys largest city and the second-largest city in the entire state the tax rate is 261. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

18 hours agoThe tax rate will be set when the council passes the FY 2023 budget in September. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. The taxable value of any property is typically.

Instead it has been property. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. Official Tax Rates Exemptions for each year.

Although its too soon to be certain current projections show the City of San Antonio could reduce its tax rate in 2023. Bexar County collects on average 212 of a propertys assessed fair market value as property tax. City staff is proposing to reduce the total tax rate from 055 to 054.

You Can See Data Regarding Taxes Mortgages Liens Much More. Its currently set at 556 cents per 100 of valuation and brings in 30 percent of the citys general fund revenue. 100 Dolorosa San Antonio TX 78205 Phone.

South San Antonio ISD. The citys current tax rate which accounts for about 22 of property tax bills is nearly 056. The citys tax rate has been at nearly 056 since 2016.

The protests can be filed online through the districts online appeals system or it could be mailed to the districts office at 411 North Frio. Emergency Service District 6. Taxing unit officials must adhere to specific procedures established in Truth and Taxation Laws when they adopt tax rates.

Property Tax Rate The property tax rate for the City of San Antonio consists of two components. See Property Records Tax Titles Owner Info More. If the city reduces its tax rate it would need the approval of council as it adopts is budget in September and it would take effect on Jan.

This compares favorably with other parts of the state. Property taxes for debt repayment are set at 21150 cents per 100 of taxable value. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

City officials have said they would rather avoid such an election. The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. Throughout Bexar county of which San Antonio is the dominant player tax rates can vary between 12 and 14.

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

How School Funding S Reliance On Property Taxes Fails Children Npr

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Tac School Property Taxes By County

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Tax Rates Bexar County Tx Official Website

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

San Antonio Property Tax Rates H David Ballinger

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Tac School Property Taxes By County

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Why Are Texas Property Taxes So High Home Tax Solutions

Tac School Property Taxes By County

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket